Medicare questions don’t end with enrollment.

We’re here to help year‑round.Medicare Supplement Insurance

Let us help you find the right insurer at any stageLearning about your Medicare options

You should receive your Medicare Part A and Part B packet in the mail approximately three months prior to your 65th birthday. Now is the time to learn about your options and determine your enrollment period for Medicare. You can also use the Medicare Eligibility and Premium Calculator to determine your Initial Enrollment Period.

For those turning 65, your enrollment period begins 3 months before the month of your 65th birthday and ends the three months after the month of their birthday. There can be penalties if you do not enroll on time, so it’s best to become familiar with your options prior to your enrollment period begins.

Medicare Premiums and Coverage

Part A has no premium; however, Part B (which covers physicians and other services) is not free and requires a monthly premium to receive this benefit. 80% of the medically necessary expenses are covered with Part A and Part B. You are financially responsible for the other 20%, which could amount to a lot of money depending on your health needs.

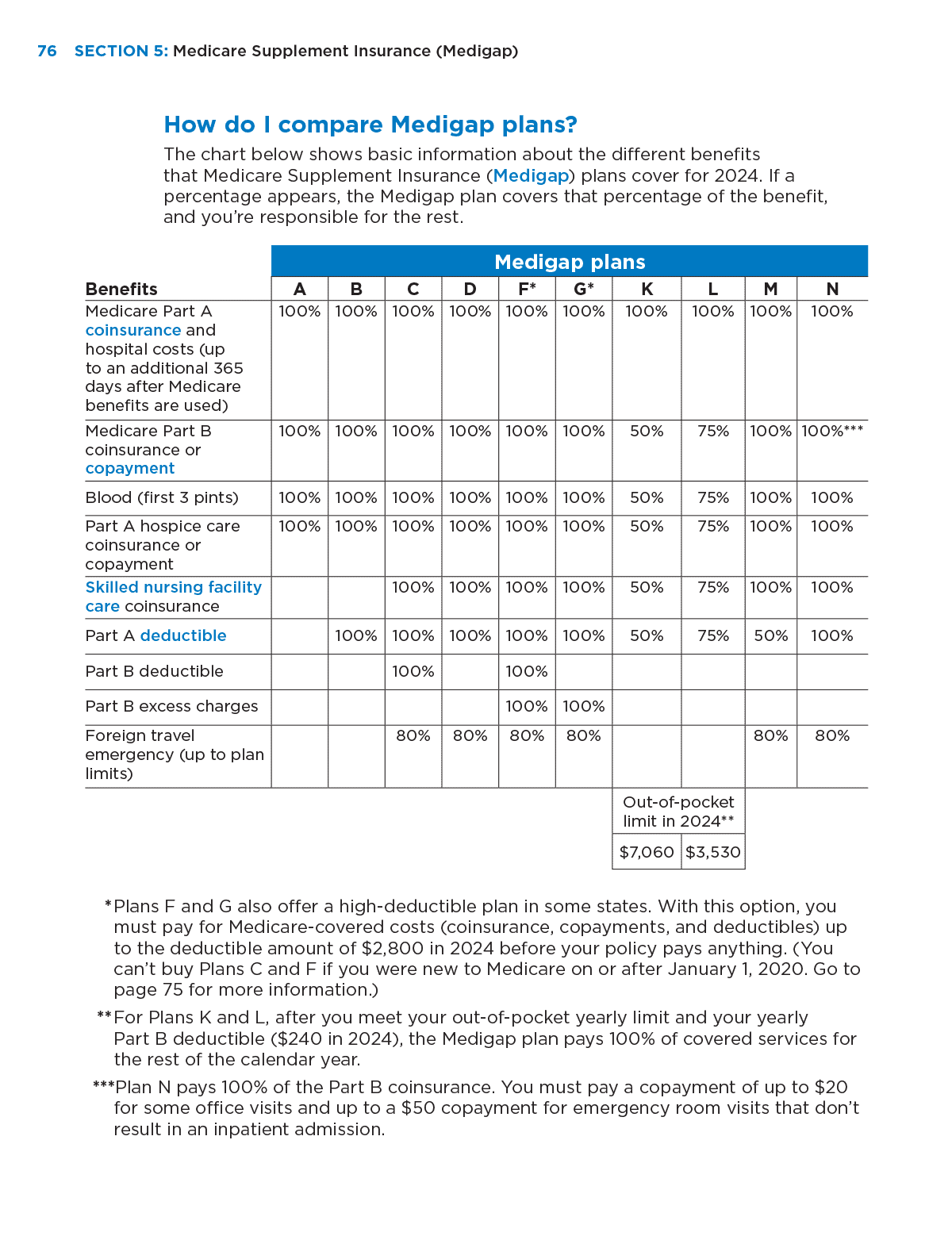

To the right is a page from the Medicare and Me Handbook 2024 which tries to guide you through comparing your options. Click on the image to enlarge it. It shows the basic services and percentages covered by the various Supplemental Plans A - N. Gaining an understanding of the percentages and what that means to you is the first step in determining which “Plan” will best suit your needs.

What if you are on a fixed income and tight budget?

First we need to understand that Medicare Supplement plans are issued by private insurers designed to fill in some of the monetary “gaps” attributable to Medicare deductibles, co-pay requirements and benefit periods.

Medicare Supplement Insurance (Medigap policies) pay for some or all of Medicare’s deductibles and co-payments not covered by Part A and Part B. Plans are standardized offering the exact same benefits.

What assurances do I have that Medigap plans are good for me?

Under the Omnibus Budget Reconciliation Act of 1990 (OBRA), Congress passed a law authorizing a standardized model for Medicare Supplement policies. That model requires Medigap plans to meet certain requirements as to participant eligibility and the benefits offered. The purpose of the law was to eliminate questionable marketing practices and standarize protection afforded to seniors.

How do Medigap plans differ?

Why should you work with us?

Our goal is to help you select a Supplemental plan that will let you rest comfortably at night knowing your financial resources are protected and will meet your health care needs.

Let's Talk

Our goal is to help you find the best value for your dollar when choosing a supplemental plan.

We can help before you turn 65 or evaluate your options to see if we can find a plan that will lower your current premiums.